The Tax Foundation faced several challenges, including complex and disorganized data structures that needed reorganization for better accessibility. Their outdated website lacked modern design and user-friendly navigation, making it less intuitive for users. Additionally, the existing site required resource-intensive and manual content curation, leading to time-consuming efforts. Furthermore, inefficient backend operations scattered data across multiple locations, making content management cumbersome and inefficient.

The Tax Foundation had a vast amount of data that needed to be organized and presented in an accessible manner. The existing site’s user experience was outdated and lacked modern design elements and cohesive, intuitive navigation.

The existing site required manual curation for landing pages and topic-based content, resulting in time-consuming efforts.

The Tax Foundation’s backend operations lacked a cohesive architecture with data dispersed across multiple locations.

Fíonta’s process for developing the most comprehensive solution began with an intensive discovery process that incorporated goal-setting, vision workshops, audience analysis, and in-depth content and user requirements discussions.

The foundation of technical and conceptual understanding led to developing a meticulous site map and architecture that defined the website’s structure, various page types, and content hierarchy. Through the creation of both low and high-fidelity wireframes, the layout and functionality of the website were presented, offering a clear representation of the intended user experience.

Fíonta’s design phase was enriched by mood boards and style tiles, facilitating the selection of fonts, colors, and graphic elements aligned with the Tax Foundation’s branding identity and overarching mission and vision. Introducing a bespoke page builder further empowered the foundation to craft dynamic pages by assembling pre-designed components adopting a customized “low code, no code” environment to preserve design consistency.

Restructuring the backend enhanced content management, enabling efficient organization, streamlined data entry, and dynamic metadata content filtering. The final product was a modern and intuitive navigation system, elevating the user experience and access.

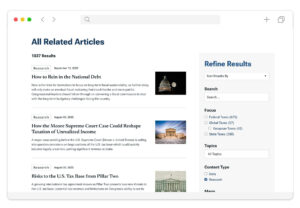

The custom page builder empowers The Tax Foundation staff to create topic-focused pages with dynamic content and filters that focus on enhancing user engagement – all without developer intervention. The assertion filter plugin enables seamless template upgrades for creating pages, filtering independently, and customizing the search experience across various pages.

The redesigned site is easy for visitors to navigate, discover, and engage with the Tax Foundation’s extensive research. The enhanced organization and filtering capabilities have increased user engagement, longer visit durations, and better content accessibility.

The Tax Foundation has a more efficient system for entering, organizing, and storing data, which allows for easier content creation, effectively reducing manual efforts.

The Tax Foundation has successfully implemented a streamlined content management system, significantly reducing manual efforts in data entry, organization, and storage. This efficiency has enabled more effective content creation. Additionally, their dynamic page creation capabilities, supported by a custom page builder and the assertion filter plugin, empower staff to create engaging, topic-focused pages without developer intervention, resulting in a more responsive and flexible website. Combined with a modern user experience that enhances navigation, engagement, and content accessibility, these improvements have increased user engagement, extended visit durations, and provided a more accessible repository of the Tax Foundation’s extensive research materials.

Steering all project facets like budget, schedule, scope, and risk management while collaborating with technical leads on risk handling, our project managers serve as the primary liaison with clients, offering frequent updates on project progress.

Dedicated to comprehending and documenting client business processes, identifying needs, and converting requirements into user stories. The business analyst works with technical leaders on the project to validate that the proposed solutions meet documented acceptance criteria and will satisfy project success metrics. Business analysts play a key role in planning for and executing user acceptance testing and training and change management when applicable.

Expertly navigating client websites to facilitate enhancements in line with organizational goals, emphasizing sustainable growth, versatile functionality, and simplified maintenance.

Focused on delivering meaningful and user-friendly experiences, our UX Consultants engage users early, prioritizing their needs and goals to ensure systems are both requirement-compliant and valuable to the end user.

Specializing in WordPress, our developer adopts a plugin-first strategy to turn designs into functional websites, leveraging extensive knowledge of WordPress plugins to ensure long-term site sustainability.